Research

At the end of May President Trump announced that the United States will impose a 5 percent tariff on all goods imported from Mexico starting on 10 June 2019. The rational for the tariffs is to incentivise Mexico to control illegal immigration coming through the United States southern border.

Most commentators state that the ultimate payer of these taxes is US consumers, especially the low income supporters of President Trump. It seems paradoxical then that he would pursue these policies with the upcoming 2020 election. A microeconomic analysis of import tariffs confirm this view.

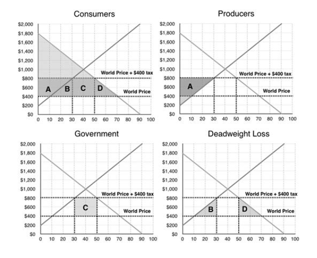

The charts below show the standard microeconomic analysis of the effect of an import tariff:

Imagine there is one good, for example beef, and there is a domestic price and a world price which includes producers from overseas. If the world price of beef is $400 then domestic consumers would demand 70 units of beef (see top left chart). The grey triangle area consisting of the light grey triangle and A+B+C+D is what is referred to as ‘consumer surplus’. Consumer surplus is defined as the difference between the total amount that consumers are willing and able to pay for a good (indicated by the downward sloping demand curve) and the total amount that they actually do pay (i.e. the world market price). This is the gain to consumers. For example, if the price of beef was $1,400 consumers would demand 20 units of beef but because the world price is $400, consumers who would have been willing to pay $1,400 for 20 units of beef only pay $400 per unit of beef and therefore save $1,000 per unit of beef. This saving is the ‘consumer surplus’. If one repeats the above process for each price point on the demand curve the total savings is represented by the grey shaded area including ‘A+B+C+D’. The top right chart shows the gain to domestic producers, known as the ‘producer surplus. Producer surplus, is defined as the difference between what producers are willing and able to supply a good for and the price they actually receive. In this example, the gain is the exceedingly small light grey triangle area below ‘A’ and that is because at a price of $400 domestic producers are only willing to supply 10 units of beef and hence do not make much money.

The situation changes dramatically once a beef import tariff of $400 is introduced. The world price of beef increases to $800. The consumer loses ‘A+B+C+D’ of consumer surplus (this is what commentators are referring to when they say consumers pay the price of the import tariffs), domestic produces gain ‘A’ in producer surplus, as they are now willing to supply 30 units of beef for $800 per unit. The government gains ‘C’ in import tariff revenue, which is calculated as the quantity of imports times the tariff in dollars. In this example, the higher overall price of beef reduces demand from 70 units to 50 units and domestic produces have increased supply to 30 units, so imports have fallen from 60 units to 20 units.

What you will notice the consumer lost ‘A+B+C+D’, the produces gained ‘A’ and the government gained ‘C’ but ‘B’ and ‘D’ were lost. In economic jargon this is referred to as a dead weight loss. It means tariffs have made the economy more inefficient and reduced economic output and growth. This is why economists are worried that tariffs can cause a recession and also why there is universal agreement amongst economists (which is rare) that free trade is good.

Is this the whole story? Has no one told President Trump about the above? Does he not understand how tariffs work?

This is not the whole story and I think he does understand how tariffs work and that in some sense given the size of the US economy, the US is arguably a ‘monosopy’, a single buyer of goods. He knows that $500bn a year to China and $300bn a year to Mexico is a lot of money for both countries.

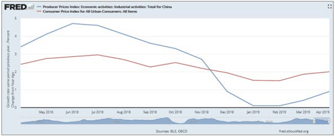

China in response to the import tariffs on their goods has subsidized it’s domestic companies so they have lower their prices by the same amount as the tariff. Which means US importers do not have to pass on the costs to US consumers…. Economists refer to this as reverse foreign aid! The chart below shows that Chinese companies have reduced their prices and US inflation has remained constant.

So when President Trump says the government is taking in billions of dollars in tax revenues and that China and Mexico will pay the cost of the tariffs not US consumers, he is right to some extent. This is assuming US companies can continue to not pass on higher import costs to US consumers because China and potentially Mexico now, continue to subsidize their companies so as not to lose market share to other countries or even US producers.