Market Update

Dovish speeches by the Fed and ECB add momentum to the global central bank pivot, supporting cross asset performance.

The Fed started the global central bank pivot, in response to what Chairman Powell refers to as ‘crosscurrents’ in global trade and global growth, by first halting further increases in the Fed Funds rate and then adopting a ‘patient’ stance about future rate rises. However, the June policy statement dropped the phrase ‘patient’ and replaced it with‘…will closely monitor… and will act as appropriate to sustain the expansion’. Markets began to price in several rate cuts, the US 10-year treasury yield fell through 2% and the US yield curve inverted around the 2yr maturity.

The ECB swiftly followed by extending forward guidance on key ECB interest rates which implied no rate rise until at least the summer of 2020 and releasing information on the new subsidized loan programme announced last quarter. More importantly, the ECB sent a strong message it was ready to provide more stimulus if risks to Eurozone growth deteriorate from a global trade war, Fed easing, a no-deal Brexit, or an Italian budget crisis.

The Bank of Japan has not partaken in the `global pivot' story as it has not changed its 2016 monetary policy framework of QQE with Yield Curve Control, which remains extremely accommodative.

So far, The Peoples Bank of China has only lowered the reserve ratio requirement to boost bank lending and has refrained from cutting interest rates to stimulate the economy. This remains a viable tool give the Fed has now halted hiking interest rates.

The Reserve Bank of India led the way for emerging markets with three rate cuts so far this year. A wave of interest rate cuts soon followed from other emerging market central banks including Russia, Philippines, Malaysia, Sri Lanka, Macedonia, Armenia, Ukraine, Malawi, Azerbaijan, Kazakhstan, Tajikistan, Kyrgyzstan, Georgia, Egypt, Gambia, Ghana, Angola, Mozambique, Rwanda, Nigeria, the Democratic Republic of Congo, Jamaica, Paraguay, and Chile.

The Reserve Bank of New Zealand was the first developed market central bank to cut interest rates this cycle. The Reserve Bank of Australia quickly followed with its own rate cut.

Noticeably absent in the `global pivot' are the Bank of England MPC members who at the June meeting voted unanimously to maintain the base rate at 0.75% and maintain the stock of corporate bond purchases at £10bn and government bond purchases at £435bn. The chances of them avoiding the `pivot' are slim to none.

The only central bank sailing against the easy money tide is the Norges Bank, the central bank of Norway. They raised interest rates by half a percent this year because of solid economic growth driven in part by a firm rebound in oil prices.

Turning away from central bank policy to trade wars and tariffs, the second quarter has been very eventful. Global equities sold off in May as trade negotiations between the United States and China broke down when the United States increased the level of tariffs from 10 percent to 25 percent on $200 billion worth of Chinese imports. The US also threatened to impose tariffs on a further $300 billion of imports from China. Furthermore, President Trump announced a series of punitive import tariffs on Mexican imports if Mexico could not control illegal immigration entering through the United States southern border. Both additional threats have been averted for now, as Mexico reached an agreement with the United States to bolster border security to reduce migrant flows and at the recent G20 meeting in Japan, the US and China agreed to continue trade negotiations.

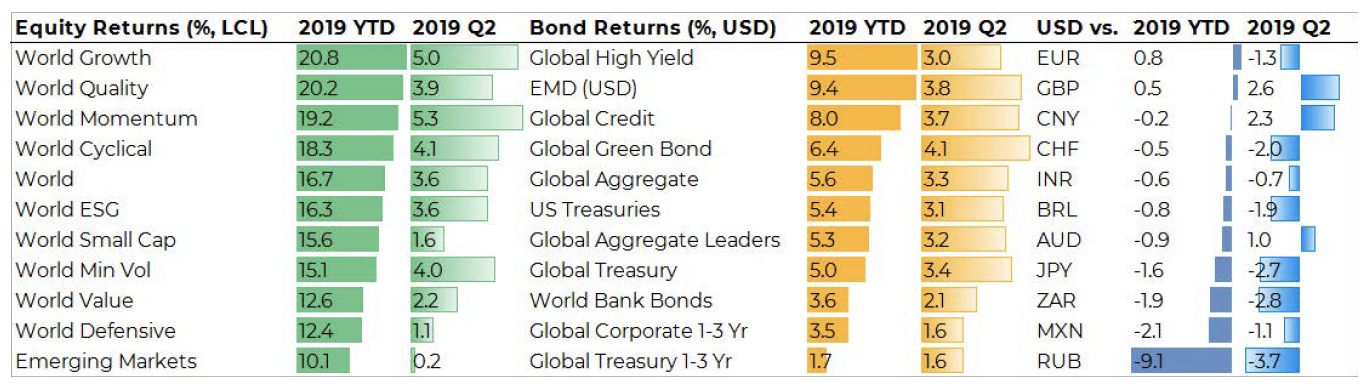

Cross asset performance remains strong year to date with equity markets delivering double digit returns across size, style, and region. Second quarter equity returns recovered May losses to end the quarter in positive territory. Momentum was the best performing equity strategy over the quarter and emerging markets were the worst performer. Fixed income has rallied alongside equities year to date with both credit and duration delivering strong returns. The positive correlation enhances multi-asset portfolio returns but amplifies potential drawdown risk. Green Bonds were the best performing fixed income strategy over the quarter and short dated treasuries were the worst performer.

Investments which have suffered this year are leveraged equity market neutral funds in a daily dealing fund structure, such as BMO Global Equity Market Neutral and Acadian Global Leveraged Market Neutral Equity. Both funds are down around 16.5% and 18.5% respectively. This is a stark reminder of the risks in buying a unitised version of a complex hedge fund strategy and that market neutral funds and/or style premia funds can still suffer the classic case of being short squeezed. As the sharp v-bound recovery got underway this year, beta neutral managers discovered the beta on their longs did not exactly match the beta on their shorts and not all style factors in a long-short multifactor model contribute the same amount of risk.

Illiquidity risks do not only involve complex equity strategies as the tragic case of Neil Woodford's equity income fund has highlighted. The manager has suspended the fund from redemption's as the percentage of unquoted holdings in the fund rose sharply following continuing investor redemptions due to poor performance over the last few years.

Alternative fixed income strategies have also come under pressure recently. H20 Asset Management, a global macro manager, suffered billions in outflows when their flagship fund H2O Allegro's exposure to illiquid private credit came under pressure. This fund was a standout performer in European alternative fixed income returning 28% in 2018. The fund is currently down 8% over the last two weeks.

In summary, global growth remains supported by firm Q1 GDP prints from the world's two largest economies (US GDP surprised massively to the upside at 3.2% annualised and China remained constant at 6.4% year on year), an OK but not great Q1 corporate earnings seasons and a loosening in global monetary policy. The areas to watch closely over the next few quarters are the oil sector (both significant moves up and down), auto sector (i.e. the German industrial engine) and the electronic sectors (the South Korean economy unexpectedly contracted in Q1). And of cause the continuation of the US-China trade dispute and the UK's trade dispute with itself, Brexit.